Revenue soaring + whether independent manufacturing can "revitalize" NIO

After experiencing layoffs and being suspected of "facing bankruptcy", NIO urgently needs good news to stabilize investors and strengthen market confidence.

On December 5, NIO’s 2023 third quarter report was long overdue: in the third quarter of this year, NIO’s operating income reached 19.067 billion yuan, an increase of 46.6% year-on-year and a month-on-month increase of 117.4%; the single quarter delivery volume was 55,400 vehicles, and the revenue and new car delivery volume reached a new high.

Benefiting from the increase in the proportion of high-priced models, the decrease in parts costs, and the increase in deliveries, NIO’s gross margin ended three consecutive quarters of decline by 11% in the third quarter, and the overall gross margin also increased from 1.0% in the second quarter to 8.0%.

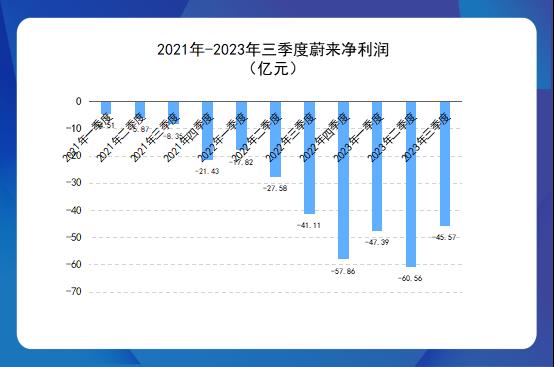

However, NIO still did not achieve profitability in the third quarter, with a net loss of 4.557 billion yuan, which is still the highest among the three "Wei Xiaoli". The loss also expanded slightly compared with the same period last year, but it narrowed significantly from the net loss of 6.056 billion yuan in the second quarter of this year.

NIO net loss. Drawing/Beijing News Shell Financial Reporter, Zhang Bing

In November this year, NIO launched an organizational adjustment, and Li Bin issued a letter to all employees, mentioning that NIO should carry out adjustments related to the direction of organization and resource investment, reduce the number of jobs by about 10% and accelerate the improvement of resource efficiency. In the future, NIO’s projects that do not improve financial performance within three years will be postponed and reduced to ensure the company’s long-term competitiveness.

During the earnings call, Li Bin revealed that the battery self-made project was assessed as unable to improve gross margins within three years, so adjustments have been made. NIO will continue to develop cells, battery materials, and packs, but will manufacture batteries through commissioned production to reduce costs.

In terms of cash reserves, as of September 30, 2023, NIO cash and cash equivalents, restricted cash, short-term investments and long-term time deposits were 45.20 billion yuan, an increase of 13.70 billion yuan from the previous quarter. This is mainly due to the delivery of $740 million of equity investments from Abu Dhabi Investments in the third quarter and the completion of a $575 million convertible senior bond issuance in September. The total delivery of the two investments is close to 10 billion yuan.

Automotive gross margin is 11%, and a new flagship model will be released in December

In the third quarter, NIO’s sales revenue was 17.409 billion yuan, an increase of 45.9% year-on-year, an increase of 142.3% month-on-month, and its share in total operating income increased to 91%.

NIO operating income and automobile sales revenue. Zhang Bing, Shell Financial Reporter, Beijing News

Benefiting from the adjustment of users’ rights and interests, NIO’s delivery volume crossed the 20,000-vehicle mark in July this year. After that, it failed to maintain the momentum of monthly sales of 20,000 vehicles. It fell to 19,300 vehicles in August. In September, NIO completed the generational switching of all products based on the second-generation platform, and the sales volume was about 16,000 vehicles.

However, from the perspective of quarterly sales, NIO delivered a total of 55,400 new cars in the third quarter, including 37,600 SUVs and 17,800 sedans, an increase of 75.4% year-on-year and 135.7% quarter-on-quarter, reaching a new high in single-quarter delivery.

Li Bin said that in the fourth quarter, the price competition in the smart electric vehicle market further intensified, and NIO improved its sales capacity and operational efficiency on the premise of maintaining price stability. He stressed that "maintaining price stability and continuously improving gross profit margin will not reduce gross profit margin in exchange for sales." In terms of product planning, NIO will release a new flagship model at NIO Day on December 23 this year. Next year, the second-generation platform products will have minor changes, but there will be no major changes to the new model. The first car of the second brand has recently completed the trial production of the VB car (development verification trial prototype).

NIO quarterly new car deliveries. Drawing/Beijing News Shell Financial Reporter, Zhang Bing

Benefiting from the increase in the proportion of high-priced models, the decrease in parts costs, and the increase in deliveries, NIO’s gross margin in the third quarter ended three consecutive quarters of decline, returning to double digits from 6.2% in the second quarter to 11%. Overall gross margin also increased from 1.0% in the second quarter to 8.0%.

NIO gross margin and gross margin. Zhang Bing, Shell Financial Reporter, Beijing News

Feng Wei, chief financial officer of NIO, said that it is expected that the gross profit margin of the whole vehicle will continue to increase in the fourth quarter of this year, and the gross profit target for the fourth quarter will remain at 15%. By 2024, with organizational adjustments and cancelled or delayed projects, NIO is expected to save 2 billion yuan in total costs.

In the power exchange business, Li Bin revealed in the earnings call that NIO plans to open the second brand of power exchange system code-named "Alps". NIO will open the second brand of battery packs and exchange stations to partners. At present, the NIO charging business has basically broken even, and some investors are interested in independent financing of NIO Power (NIO Power system). There are also some preliminary contacts. Independent financing of NIO Power cannot be ruled out in the future.

"If you are independentManufacturing, manufacturing costs will decrease by 10% "

On the day of the release of its third-quarter results, NIO said it had signed a definitive agreement with the joint stock company of Anhui Jianghuai Automobile Group (referred to as "Jianghuai") to acquire certain production equipment and assets. According to the agreement, NIO will acquire the production equipment and assets of the first advanced manufacturing base and the second advanced manufacturing base from Jianghuai. The total price excluding tax is about RMB 3.16 billion.

NIO established a cooperative relationship with Jianghuai Automobile to produce automobiles in 2016.

From the first ES8 production car rolled off the production line in May 2018 to the end of 2022, it took 4 years and 7 months for Jianghuai Automobile to OEM more than 300,000 production cars for NIO. With the increase in delivery volume, the OEM cost paid by NIO to Jianghuai Automobile also continued to grow. According to NIO’s financial report data, from 2018 to 2022, NIO paid Jianghuai Automobile about 223 million yuan, 441 million yuan, 532 million yuan, 715 million yuan and 1.127 billion yuan respectively, and included in the cost of sales. During the 5 years, NIO has paid about 3.038 billion yuan to Jianghuai Automobile.

On December 4, NIO Technology (Anhui) Co., Ltd. appeared in MIIT’s "vehicle manufacturer credit information management system", and the production address was displayed as No. 299 Baita Road, Economic and Technological Development Zone, Hefei City, Anhui Province. This means that NIO seeks to build cars independently or go further.

In the earnings call, Mr. Li did not directly address the issue of vehicle qualifications, but he noted that "from a manufacturing perspective, if we manufacture entirely independently, the manufacturing cost will drop by 10 percent."

Zhang Bing, Shell Financial Reporter, Beijing News

Editor, Chao Xu

Proofreading, Liu Baoqing