Announcement of Listed Companies in Shenzhen (September 20th)

Game ETF callback, the highest drop of 2.21%; "share-based champion" returns to public offering

Tianci Liangji Daily No.261 I. A quick look at today’s fund news

1. Ma Cheng, former general manager of Changan Fund, resigned, and Sun Yewei became the new general manager.

Recently, Chang ‘an Fund announced that the former general manager Ma Yuan resigned as the general manager for personal reasons, and Sun Yewei became the new general manager of the company. (Via: national business daily)

2. The main dividend-paying debt base has distributed 108.3 billion benefits during the year.

The data shows that 1919 bond funds paid dividends during the year, with a total dividend of 108.336 billion yuan, accounting for 85.94% of the total dividends of the funds in the same period, exceeding the total dividend of 3.73% in the same period last year. (Via: Shenzhen Business Daily)

3. Thousands of products are on the verge of liquidation.

As of September 18th, there are more than 5,800 funds with a scale of less than 50 million yuan, of which more than 2,600 funds with a scale of less than 10 million yuan. (Via: china securities journal)

4. Billion private placement positions hit a new high in the year.

According to the data of private placement network, the index of stock private placement position was 81.70%, which was basically the same as last week. Private placement position remained at a high level and stood at the 80% mark for two consecutive weeks. (Via: Shenzhen Business Daily) Second, the latest developments of well-known fund managers

1. Sun Jianbo joined the Green Fund.

It is reported that Sun Jianbo, one of the "Three Musketeers" of the former Chinese Business Fund, returned to the public offering and joined the Green Fund. According to the data, in 2010, Sun Jianbo, Zhuang Tao and Liang Yongqiang, the Chinese businessman Shengshi Growth, managed together, won the equity fund champion of that year.

2. Zhou Xue Junqi’s next fund lightened Honglu steel structure.

According to the data on September 15th, () in the list of the top ten tradable shareholders, Zhou Xuejun’s reform-driven Haifutong appeared in a mixed way, with a decrease of 390,300 shares compared with the end of the second quarter.

3. Gao Bing investigates Kangda new materials.

On September 18th, () was investigated by the organization, and Gao Bing of Chinese Business Fund appeared. The data in the past six months show that Gao Bing has not yet held the stock in the fund management. Third, today’s ETF market comments

1. ETF market resumption

The market fluctuated and divided all day. At the close, the Shanghai Composite Index fell 0.03%, the Shenzhen Component Index fell 0.73%, and the Growth Enterprise Market Index fell 0.88%. The turnover of Shanghai and Shenzhen stock markets was 635 billion, up from 63.5 billion in the previous trading day. Northbound funds sold a net of 2.423 billion yuan throughout the day. In terms of sectors, railways and highways, cement and building materials, petroleum and other sectors were among the top gainers, while tourist hotels, small metals and software development were among the top losers.

Specifically, dividend ETFs occupy a leading position in the whole ETF market. In addition to several ETFs that track the CSI dividend index, ETFs that track the dividend-related indexes of Hong Kong stocks are also eye-catching, with the highest rise of 1.67%. In addition, oil and gas stocks opened higher, () rose by more than 5%, driving energy and oil and gas-related ETFs to strengthen.

In terms of decline, many game ETFs pulled back, with the highest drop of 2.21%.

2. ETF theme opportunities

Against the background of the strong US dollar index and the interest rate hike cycle, the international oil price has continued to rise recently, and Brent crude oil closed above 90 US dollars/barrel, up about 25% from the end of the second quarter.

Domestically, in the first half of 2023, the performance of "three barrels of oil" was brighter than that of overseas oil companies. Under the trend of ROE restoration, the valuation level of "three barrels of oil" is expected to be restored. Through years of increasing reserves and increasing production, reducing costs and increasing efficiency, the upstream business of "three barrels of oil" has performed better than overseas oil giants in terms of production and reserve growth, cost control and capital expenditure.

Comments: This year’s domestic economic recovery has led to the growth of global crude oil demand, and overseas markets may be worried that the economic recession will lead to a decline in crude oil demand. Looking at the domestic and international situation, the global demand for crude oil is still growing. Therefore, it is unlikely that the oil price will drop sharply, and the oil price may continue to run at a high level.

Fourth, focus on emerging funds tomorrow.

1. Fund abbreviation: Huatai Bairui China-Korea semiconductor ETF initiated connection.

Fund type: QDII

Fund Manager: Li Muyang

Performance benchmark: the yield of China-Korea semiconductor index of CSI Korea Exchange × 95%+bank deposit interest rate (after tax) ×5%.

Past performance of fund managers:

Game ETF callback, the highest drop of 2.21%; "share-based champion" returns to public offering

Tianci Liangji Daily No.261 I. A quick look at today’s fund news

1. Ma Cheng, former general manager of Changan Fund, resigned, and Sun Yewei became the new general manager.

Recently, Chang ‘an Fund announced that the former general manager Ma Yuan resigned as the general manager for personal reasons, and Sun Yewei became the new general manager of the company. (Via: national business daily)

2. The main dividend-paying debt base has distributed 108.3 billion benefits during the year.

The data shows that 1919 bond funds paid dividends during the year, with a total dividend of 108.336 billion yuan, accounting for 85.94% of the total dividends of the funds in the same period, exceeding the total dividend of 3.73% in the same period last year. (Via: Shenzhen Business Daily)

3. Thousands of products are on the verge of liquidation.

As of September 18th, there are more than 5,800 funds with a scale of less than 50 million yuan, of which more than 2,600 funds with a scale of less than 10 million yuan. (Via: china securities journal)

4. Billion private placement positions hit a new high in the year.

According to the data of private placement network, the index of stock private placement position was 81.70%, which was basically the same as last week. Private placement position remained at a high level and stood at the 80% mark for two consecutive weeks. (Via: Shenzhen Business Daily) Second, the latest developments of well-known fund managers

1. Sun Jianbo joined the Green Fund.

It is reported that Sun Jianbo, one of the "Three Musketeers" of the former Chinese Business Fund, returned to the public offering and joined the Green Fund. According to the data, in 2010, Sun Jianbo, Zhuang Tao and Liang Yongqiang, the Chinese businessman Shengshi Growth, managed together, won the equity fund champion of that year.

2. Zhou Xue Junqi’s next fund lightened Honglu steel structure.

According to the data on September 15th, in the list of the top ten tradable shareholders of Honglu Steel Structure, Zhou Xuejun’s reform of Haifutong was mixed, with a decrease of 390,300 shares compared with the end of the second quarter.

3. Gao Bing investigates Kangda new materials.

On September 18th, Kangda New Materials was investigated by institutions, and Gao Bing of Chinese Business Fund appeared. The data in the past six months show that Gao Bing has not yet held the stock in the fund management. Third, today’s ETF market comments

1. ETF market resumption

The market fluctuated and divided all day. At the close, the Shanghai Composite Index fell 0.03%, the Shenzhen Component Index fell 0.73%, and the Growth Enterprise Market Index fell 0.88%. The turnover of Shanghai and Shenzhen stock markets was 635 billion, a decrease of 63.5 billion compared with the previous trading day. Northbound funds sold a net of 2.423 billion yuan throughout the day. In terms of sectors, railways and highways, cement and building materials, petroleum and other sectors were among the top gainers, while tourist hotels, small metals and software development were among the top losers.

Specifically, dividend ETFs occupy a leading position in the whole ETF market. In addition to several ETFs that track the CSI dividend index, ETFs that track the dividend-related indexes of Hong Kong stocks are also eye-catching, with the highest rise of 1.67%. In addition, oil and gas stocks opened higher, and Guanghui Energy rose more than 5%, driving energy and oil and gas-related ETFs to strengthen.

In terms of decline, many game ETFs pulled back, with the highest drop of 2.21%.

2. ETF theme opportunities

Against the background of the strong US dollar index and the interest rate hike cycle, the international oil price has continued to rise recently, and Brent crude oil closed above 90 US dollars/barrel, up about 25% from the end of the second quarter.

Domestically, in the first half of 2023, the performance of "three barrels of oil" was brighter than that of overseas oil companies. Under the trend of ROE restoration, the valuation level of "three barrels of oil" is expected to be restored. Through years of increasing reserves and increasing production, reducing costs and increasing efficiency, the upstream business of "three barrels of oil" has performed better than overseas oil giants in terms of production and reserve growth, cost control and capital expenditure.

Comments: This year’s domestic economic recovery has led to the growth of global crude oil demand, and overseas markets may be worried that the economic recession will lead to a decline in crude oil demand. Looking at the domestic and international situation, the global demand for crude oil is still growing. Therefore, it is unlikely that the oil price will drop sharply, and the oil price may continue to run at a high level.

Fourth, focus on emerging funds tomorrow.

1. Fund abbreviation: Huatai Bairui China-Korea semiconductor ETF initiated connection.

Fund type: QDII

Fund Manager: Li Muyang

Performance benchmark: the yield of China-Korea semiconductor index of CSI Korea Exchange × 95%+bank deposit interest rate (after tax) ×5%.

Past performance of fund managers:

Luyan Medicine plans to increase the capital of Hainan subsidiary to 100 million yuan.

() Recently, it was announced that Hainan Luyan Pharmaceutical Co., Ltd., a holding subsidiary of the company, plans to increase its registered capital from 35 million yuan to 100 million yuan due to the needs of business development and the construction of Luyan Pharmaceutical Hainan headquarters base project.

The board of directors of the company agreed that the company and other shareholders of Hainan Luyan increased their capital year-on-year. Among them, the company (holding 90% equity of Hainan Luyan) increased its capital by 58.5 million yuan in cash; Hainan Rang Sanchi Technology Trading Co., Ltd. (holding 4% equity of Hainan Luyan) increased its capital by 2.6 million yuan in cash; Hainan Guokang Future Health Industry Management Group Co., Ltd. (holding 3% equity of Hainan Luyan) increased its capital by 1.95 million yuan in cash; Hainan Qize Yisheng Trade Co., Ltd. (holding 3% equity of Hainan Luyan) increased its capital by 1.95 million yuan in cash.

In the first half of 2023, the company’s operating income was about 10.024 billion yuan, a year-on-year increase of 7.32%; The net profit attributable to shareholders of listed companies was about 189 million yuan, up 12% year-on-year; The basic earnings per share was 0.49 yuan, up 13.95% year-on-year.

The reconstruction and expansion project of coenzyme Q10 of Jindawei subsidiary was approved by EIA.

() Announcement: Inner Mongolia Jindawei Pharmaceutical Co., Ltd. (hereinafter referred to as "Jindawei Pharmaceutical"), a wholly-owned subsidiary of the company, recently received the Reply on the Environmental Impact Report of the Coenzyme Q10 Reconstruction and Expansion Project of Inner Mongolia Jindawei Pharmaceutical Co., Ltd. issued by Hohhot Ecological Environment Bureau (Huhuan Zhengpi Zi [2023] No.200).

The reply agrees that Jindawei Pharmaceutical will build a reconstruction and expansion project with an annual output of 620 tons of coenzyme Q10 in Jindawei Pharmaceutical Factory, Tuoketuo Industrial Park, Hohhot, and implement various environmental protection requirements put forward in the reply to ensure the discharge of pollutants up to standard, and strictly implement the "three simultaneous systems" of environmental protection in which supporting environmental protection facilities are designed, constructed and put into use at the same time as the main project. The total investment of the project is 320 million yuan.

Zhenghai Bio has obtained a medical device registration change document.

() Announcement, the company has recently obtained a Document of Medical Device Change Registration (Filing) issued by National Medical Products Administration, and the company has completed the change of product technical requirements related to the product "Skin Repair Membrane".

Ruifeng Gaocai set up a Vietnamese subsidiary to promote overseas market expansion

() Announced that in order to implement the strategic planning and layout of overseas business, enhance the competitiveness in the international market and expand the business coverage, the company invested its own funds to set up a wholly-owned subsidiary in Vietnam. Recently, the Vietnamese subsidiary has completed the registration formalities in industrial and commercial registration and obtained the Business License. The company name is Ruifeng Gaocai Economic and Trade Co., Ltd., with a registered capital of 9.4 billion VND (US$ 400,000), and its business scope is to sell plastic additives and products (PVC additives, engineering plastic additives, biodegradable materials).

In recent years, Southeast Asia, especially Vietnam, has become an important export destination of the company’s products, and the company’s customer resources are more and more concentrated. In order to facilitate the export of the company’s products, serve customers and open up the international market, it is necessary to set up a wholly-owned trading subsidiary in Vietnam. This investment in establishing a wholly-owned subsidiary in Vietnam is based on the needs of the company’s strategic layout, which is of great significance to promoting the company’s overseas market expansion and improving the comprehensive competitiveness of the industry.

Yunhai Metal: On September 20th, the short name of the securities was changed to "Baowu Magnesium Industry".

() It was announced on the evening of September 19th that since September 20th, 2023, the Chinese name of the company has been changed from "Nanjing Yunhai Special Metals Co., Ltd." to "Baowu Magnesium Technology Co., Ltd.", and the short name of the securities has been changed from "Yunhai Metal" to "Baowu Magnesium Industry".

Huatian Hotel intends to be entrusted with the management of 80% equity of Sunshine Wine Pipe to solve the problem of horizontal competition with the controlling shareholder.

() Announcement: In order to solve the problem of horizontal competition between the controlling shareholder Hunan Sunshine Huatian Tourism Development Group Co., Ltd. ("Hunan Tourism Group") and the company, it is proposed that the company be entrusted to manage 80% equity of its subsidiary Hunan Sunshine Hotel Management Co., Ltd. ("Sunshine Group"), a wholly-owned subsidiary of Hunan Tourism Group. The custody period shall be from the effective date of the equity custody agreement to December 31, 2026.

Huatian Hotel: It is planned to be entrusted to manage 80% equity of Sunshine Wine Tube.

Huatian Hotel announced on the evening of September 19 that in order to solve the problem of horizontal competition between Hunan Tourism Group, the controlling shareholder, and the company, it is proposed that the company be entrusted to manage 80% equity of Sunshine Wine Management, a subsidiary of Hunan Tourism Group. The custody period shall be from the effective date of the equity custody agreement to December 31, 2026.

All 5.09 million shares of Zhongchuang Environmental Protection Phase II Employee Stock Ownership Plan have been sold and liquidated.

() Last night, the announcement about the completion of the stock sale and liquidation of the second employee stock ownership plan was disclosed. As of the disclosure date of the announcement, 5,094,440 shares (accounting for 1.32% of the company’s total share capital) held by Zhongchuang Environmental Protection’s second employee stock ownership plan have all been sold, the employee’s principal and interest have been returned, and the liquidation has been completed.

According to the announcement of Zhongchuang Environmental Protection, the company held the 23rd meeting of the 4th Board of Directors and the 23rd meeting of the 4th Board of Supervisors on October 23rd, 2020, and reviewed and passed the Proposal on and its Summary, the Proposal on and other related proposals. Independent directors of the company expressed their independent opinions on the implementation of the employee stock ownership plan. On November 11th, 2020, the company convened the fourth extraordinary shareholders’ meeting in 2020 to review and approve matters related to the second employee stock ownership plan, and agreed to implement the second employee stock ownership plan.

On March 15th, 2021, the company received the Confirmation of Securities Transfer Registration issued by China Securities Depository and Clearing Co., Ltd. Shenzhen Branch. On March 12th, 2021, the 5,094,440 shares held by the company’s repurchase special securities account were transferred to the special securities account of Xiamen Zhongchuang Environmental Protection Technology Co., Ltd.-Phase II Employee Stock Ownership Plan. At this point, the second phase of the company’s employee stock ownership plan has all completed the non-trading transfer of shares.

On June 12, 2023, the company held the 20th meeting of the 5th Board of Directors and the 16th meeting of the 5th Board of Supervisors, which deliberated and passed the Proposal on Invalidating the 2nd Employee Stock Ownership Plan, and agreed to terminate the implementation of the 2nd Employee Stock Ownership Plan of the company, together with the accompanying Management Measures for the 2nd Employee Stock Ownership Plan of the company. The independent directors of the company issued independent opinions on related matters, and the board of supervisors issued verification opinions on related matters. The company will sell the stock at the right time, return the employee’s principal and interest, and the remaining funds will belong to the company, and confirm the capital reserve, which will not affect the company’s profit and loss.

Xinbeiyang subsidiary won the bid for the procurement project of upgraded self-service teller machines of China Construction Bank.

() Announcement: Weihai Xinbeiyang Rongxin Technology Co., Ltd. (hereinafter referred to as "Rongxin Technology"), a holding subsidiary of the company, recently received the Notice of Winning Bid issued by CITIC International Bidding Co., Ltd., and confirmed Rongxin Technology as "the winning bidder of China Construction Bank Co., Ltd. upgraded ATM procurement project (project number: ZH230166/01)".

Winning the bid for this project has further deepened the cooperation between the company and large state-owned banks, indicating that Rongxin Technology’s products and services have continuously won the trust of the market and customers, and its market competitiveness has been continuously improved. At the same time, it further consolidated and enhanced the influence of Rongxin Technology in the field of financial equipment. The successful signing and implementation of the follow-up projects is expected to have a positive impact on the company’s financial market development and operating performance.

The concerted action of the controlling shareholder of Liande Equipment mistakenly bought and terminated the reduction plan in advance.

Last night, () issued an announcement about the concerted action of the controlling shareholder of the company to buy and sell the company’s shares due to misoperation and terminate the reduction plan ahead of schedule. Liande Equipment said that on September 15, 2023, the company received the "Notice on the Misoperation of Buying and Selling Company Stocks and the Early Termination of the Share Reduction Plan" issued by Nie Jian, the concerted action person of the company’s controlling shareholder, and learned that Nie Jian bought 400 shares of the company due to misoperation during the implementation of the reduction, resulting in short-term trading behavior.

From June 29th, 2023 to September 14th, 2023, Nie Jian sold 6,000 shares of the company through centralized bidding.

During the implementation of the reduction plan, Nie Jian bought 400 shares of the company at an average transaction price of 25.17 yuan/share on September 15, 2023 due to misoperation, resulting in short-term trading behavior. Immediately after Nie Jian discovered the wrong operation, he issued to the board of directors the "Notice on the situation of buying and selling the company’s shares due to wrong operation and the early termination of the share reduction plan".

It is reported that on June 5, 2023, Liande Equipment disclosed the "Pre-disclosure Announcement on the Company’s Controlling Shareholder’s Concerted Action to Reduce Shares" (AnnouncementNo.: 2023-047), which revealed that Nie Jian, the company’s controlling shareholder’s concerted action, planned to reduce the company’s shares by centralized bidding or block trading, accounting for 0.02% of the company’s total share capital. Among them, if the holdings are reduced by centralized bidding, the reduction period is within 6 months (June 29, 2023-December 28, 2023) after 15 trading days from the date of announcement; If the holdings are reduced by block trading, the reduction period is within 6 months (June 9, 2023-December 8, 2023) after 3 trading days from the date of announcement.

Liande Equipment pointed out that regarding the handling of this short-term transaction and the remedial measures taken by the company, the board of directors of the company attached great importance to it after learning about it, and checked the relevant situation in time. Nie Jian also actively cooperated and took the initiative to correct it. The handling of this matter and the measures taken are as follows:

According to the method of subtracting the average buying price from the highest selling price during the implementation of the above-mentioned reduction plan, the calculation method of the short-term trading income is: (highest selling price-lowest buying price) × number of shares bought =(27.10 yuan/share -25.17 yuan/share )× 400.

Shares =772 yuan. That is, the income of 772 yuan will be turned over to the company in full.

The above-mentioned violations were indeed caused by Nie Jian’s operational mistakes, and there was no case of trading the company’s shares because of insider information, nor did there exist the purpose of seeking benefits by using short-term trading. Nie Jian’s misoperation does not have the subjective intention of short-term trading, and he has deeply realized the seriousness of this short-term trading. He sincerely apologizes for the adverse impact of short-term trading caused by this misoperation on the company and the market, and will consciously abide by the provisions of the Securities Law prohibiting short-term trading, stop buying and selling the company’s shares within 6 months from the date of the above-mentioned short-term trading behavior, terminate the reduction plan ahead of schedule, and promise to strictly implement the Securities Law and the provisions of the CSRC and Shenzhen Stock Exchange on shareholder reduction in the future.

The company will further require all directors, supervisors and senior managers to strengthen the Company Law, Securities Law, Rules for Listing on Growth Enterprise Market of Shenzhen Stock Exchange, Guidelines for Self-regulation of Listed Companies of Shenzhen Stock Exchange No.2-Standardized Operation of Listed Companies on Growth Enterprise Market, Several Provisions on Shareholding Reduction by Shareholders and Directors, Supervisors and Senior Managers of Listed Companies of Shenzhen Stock Exchange, and other relevant laws.

Zhongwei shares: signed a joint venture agreement with AL MADA

() Announcement, signing a joint venture agreement with AL MADA. According to the project joint venture agreement, based on the complementarity and compatibility of all parties in strategic cooperation, in order to give full play to the advantages of all parties in technology, resources and location, enhance the efficiency of enterprises and achieve win-win cooperation. All parties agree to build a new energy green industrial park in Morocco by taking advantage of Morocco’s geographical location and its advantages in green energy, and the joint venture company registered by all parties (or their affiliated companies) in Casablanca will implement the project. The joint venture company is held by Zhongwei Morocco New Energy, with 50.03% and NGI holding 49.97%.

New Beiyang: The holding subsidiary won the bid for the procurement project of the upgraded self-service teller machine of China Construction Bank.

New Beiyang announced on the evening of September 19th that Rongxin Technology, a holding subsidiary of the company, recently received the Notice of Winning Bid issued by CITIC International Tendering Co., Ltd., and confirmed Rongxin Technology as the winning bidder of China Construction Bank Co., Ltd. upgraded ATM procurement project.

The new securities of Yunhai Metal, referred to as "Baowu Magnesium Industry", was launched on September 20th.

Yunhai Metal announced that the company has completed the registration and filing procedures for the industrial and commercial change of the company name and registered capital, and obtained the Business License renewed by Nanjing Municipal Market Supervision Administration.

The Chinese name of the company was changed from "Nanjing Yunhai Special Metal Co., Ltd." to "Baowu Magnesium Technology Co., Ltd.", and the short name of the securities was changed from "Yunhai Metal" to "Baowu Magnesium Industry". The registered address was changed from No.9 Xiushan East Road, Lishui Economic Development Zone, Nanjing to No.11 Kaiping Road, Dongping Street, Lishui District, Nanjing. The opening date of the company name and securities abbreviation is September 20, 2023.

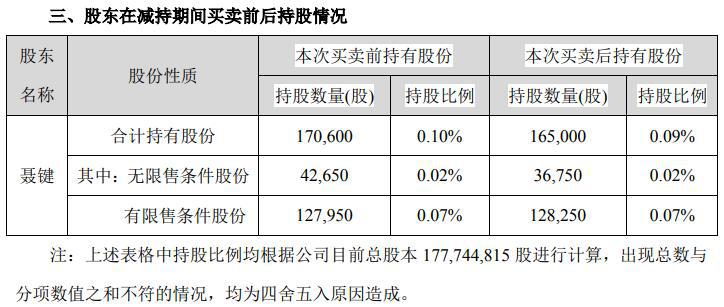

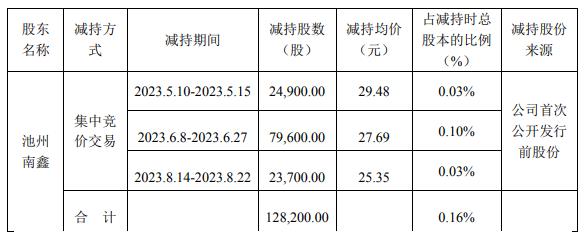

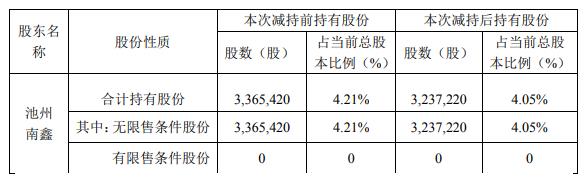

Aikelan’s shareholder Chizhou Nanxin reduced its holdings by 128,200 shares and went public in 2020 to raise 400 million shares.

() Yesterday, an announcement was issued about the expiration of the period of some shareholders’ reduction plans.

On February 23rd, 2023, Anhui Aikelan Environmental Protection Co., Ltd. disclosed the Announcement on Pre-disclosure of Share Reduction by Some Shareholders (AnnouncementNo.: 2023-007). Chizhou Nanxin Business Consulting Enterprise (Limited Partnership) (hereinafter referred to as "Chizhou Nanxin"), a shareholder of the company, holds 3,365,420 shares (accounting for 4.20% of the company’s total share capital), and plans to make a pre-disclosure announcement on its own reduction.

Recently, the company received the Notice Letter on the Expiration of the Share Reduction Plan issued by Chizhou Nanxin. According to the Listing Rules of the Growth Enterprise Market of Shenzhen Stock Exchange and the Detailed Rules for the Implementation of the Share Reduction of Shareholders, Directors, Supervisors and Senior Management of Listed Companies of Shenzhen Stock Exchange, as of the disclosure date of the announcement, the above-mentioned share reduction plan has expired.

Chizhou Nanxin reduced its holdings by a total of 128,200 shares for three times, accounting for 0.16% of the total share capital at the time of reduction. After calculation, the total cash reduction is 3,538,971 yuan.

There is no difference between the implementation of this reduction plan and the previously disclosed reduction plan and related commitments. As of the date of this announcement, Chizhou Nanxin’s reduction plan has expired and has fulfilled its information disclosure obligations in accordance with relevant regulations.

Chizhou Nanxin is not the controlling shareholder or actual controller of the company, and the implementation of its reduction plan will not lead to the change of the company’s control right and will not affect the company’s sustainable operation.

Ai Kelan landed on the Growth Enterprise Market of Shenzhen Stock Exchange on February 10th, 2020, and made an initial public offering of 20 million shares at an issue price of 20.28 yuan/share. The sponsor was Dongxing Securities, and the sponsors were Cui Yongxin and Qin Xinlin.

The total amount of funds raised by Aikelan this time is 406 million yuan, and the net amount of funds raised after deducting the issuance expenses is 365 million yuan. It is planned to invest in the following projects: 1. Upgrading and expanding the production of engine exhaust aftertreatment products, with a total investment of 190 million yuan and an investment of 189 million yuan; 2. R&D center construction project, with a total investment of 86,772,700 yuan and a raised capital investment of 86 million yuan; 3. Replenish working capital. The total investment of the project is 150 million yuan, and the amount of raised funds is 90,179,200 yuan.

Ai Kelan’s issuance fee was 40.4208 million yuan, of which Dongxing Securities received underwriting fee and sponsorship fee of 28.3019 million yuan, Dahua Certified Public Accountants and Rongcheng Certified Public Accountants received audit and capital verification fee of 5.7075 million yuan, and Beijing Zhonglun Law Firm received lawyer fee of 2.2642 million yuan.

() It is planned to transfer 70% equity of Jiangxi Fuhuang Steel Structure to Jiangxi Fuhuang Construction Engineering to accelerate the development strategy in Jiangxi.

Fuhuang Steel announced that in order to adapt to the company’s strategic development in Jiangxi, the company transferred 70% equity of its holding subsidiary Jiangxi Fuhuang Steel Structure Co., Ltd. (hereinafter referred to as "Jiangxi Fuhuang Steel Structure") to its wholly-owned subsidiary Jiangxi Fuhuang Construction Engineering Co., Ltd. (hereinafter referred to as "Jiangxi Fuhuang Steel Structure"), and at the same time increased the registered capital of Jiangxi Fuhuang Construction Engineering. After the above equity transfer is completed, Jiangxi Fuhuang Construction Engineering holds 70% equity of Jiangxi Fuhuang Steel Structure, and the company will no longer directly hold 70% equity of Jiangxi Fuhuang Steel Structure, and increase the registered capital of Jiangxi Fuhuang Construction Engineering with 70% equity assets of Jiangxi Fuhuang Steel Structure according to the book value, and the registered capital of Jiangxi Fuhuang Construction Engineering will increase from 200 million yuan to 256 million yuan.

The company said that this equity transfer is conducive to optimizing the business system of the company and its subsidiaries, clarifying the strategic layout of the company and the responsibilities of each business segment, improving the management efficiency of the company and its subsidiaries, accelerating the development strategy of the company in Jiangxi, and achieving sustainable and high-quality development.

Zhuo Chuang Information sends 4 yuan date of record every 10 shares every six months for September 25th.

() It is announced that the company will distribute the rights and interests in the first half of 2023, and distribute cash dividends to all shareholders for every 10 shares (including tax) in 4 yuan and date of record on September 25th.

(): The subsidiary and () supply chain company signed the General Rules for Purchasing Productive Materials of Auto Parts.

Hongchang Electronics announced on the evening of September 19th that Zhuhai Hongchang, a wholly-owned subsidiary, and BYD Supply Chain Company signed the General Rules for Purchasing Productive Materials of Auto Parts, and BYD Supply Chain Company will purchase epoxy resin from Zhuhai Hongchang. The specific purchase model, purchase quantity and purchase price shall be subject to the purchase contract/order signed separately by both parties.

Gui Faxiang appointed Guo Shuang as Chief Financial Officer.

() Announcement, Jiang Guijie, the deputy general manager of the company, continues to serve as the deputy general manager of the company because of his job adjustment and no longer serves as the chief financial officer; Upon nomination by the general manager and review by the Nomination Committee of the Board of Directors, the Board of Directors decided to appoint Guo Shuang as the company’s chief financial officer and Ma Tianlu as the company’s deputy general manager, with the term of office from the date of deliberation and approval by the Board of Directors to the date of expiration of the fourth board of directors.

Zhongwei shares signed a joint venture agreement with AL MADA

Zhongwei shares announced that the board of directors of the company reviewed and approved the Proposal on Signing a Joint Venture Agreement with AL MADA, and agreed that the company and its wholly-owned subsidiary Zhongwei Morocco New Energy signed the Joint Venture Agreement with AL MADA and its subsidiary NGI and CNGR NEW TECH MOROCCO (joint venture company). According to the project joint venture agreement, all parties agreed to build a new energy green industrial park in Morocco by taking advantage of Morocco’s geographical location and its advantages in green energy, and the joint venture company registered by all parties (or their affiliated companies) in Casablanca will implement the project. The joint venture company is held by Zhongwei Morocco New Energy and NGI holds 50.03% and 49.97% respectively. The project includes the construction of ternary precursor integration, Ferrous lithium phosphate integration, black powder recovery factory and Morocco-China green energy industrial park, and the realization of annual output of 120,000 tons of ternary precursor, 60,000 tons of Ferrous lithium phosphate and 30,000 tons of black powder recovery. Each project is operated and managed by an independent subsidiary set up by the joint venture company, which is subject to the investment agreement actually signed by a single project.

Longkun Environment plans to send 10 shares to 2 yuan for ex-dividend on September 26th.

() Announcement, the company plans to distribute the rights and interests in the first half of 2023: 2.00 yuan (including tax) for every 10 shares of all shareholders; Ex-dividend date: September 26, 2023.

() Half-year equity distribution in 2023: every 10 shares will be distributed to 2.5 yuan for equity registration on September 25th.

Nanwang Technology announced that the company’s equity distribution plan for the first half of 2023 is: based on the company’s existing total share capital, a cash dividend of 2.5 yuan RMB (including tax) will be distributed to all shareholders for every 10 shares, with date of record on September 25th, 2023 and ex-dividend date on September 26th, 2023.

Nie Lulu, the major shareholder of Huawu Co., Ltd., did not reduce his holdings when he reduced his holdings.

() Announcement: Nie Lulu, the concerted action of shareholders and controlling shareholders who hold more than 5% of the shares of the company, did not reduce the shares during this share reduction plan, and the period of this reduction plan has expired.

Today, every 10 shares in the international half year of 2023 will be sent to 3 yuan and date of record as September 25th.

() Announced, the contents of the company’s equity distribution implementation plan for the first half of 2023 are as follows: based on the total share capital of 310,231,300 shares, a cash dividend of RMB 3.00 will be distributed to all shareholders for every 10 shares, and a total cash dividend of RMB 93,069,400 will be distributed, accounting for 43.32% of the net profit attributable to the mother in the same period. No bonus shares will be distributed, and no capital reserve will be converted into share capital.

The distribution of rights and interests in date of record is September 25th, and the ex-dividend date is September 26th.

According to the semi-annual performance report for 2023 released by International today, the company’s operating income was 1.562 billion yuan, up 34.28% year-on-year; The net profit attributable to shareholders of listed companies was 215 million yuan, a year-on-year increase of 101.49%; The basic earnings per share was 0.70 yuan, compared with 0.35 yuan in the same period last year.

The main business of Shenzhen Today International Logistics Technology Co., Ltd. is to provide integrated services such as planning and design of automatic production line and logistics system, system integration, software development, equipment customization, electronic control system development, on-site installation and debugging, customer training and after-sales service for manufacturing and distribution enterprises. The main products or services are intelligent logistics and intelligent manufacturing system integrated solutions, operation and maintenance services, etc. In 2019, the company obtained the national high-tech enterprise certificate. The company has an excellent R&D team composed of engineers such as system planning and design, system integration, software development, industrial robots and logistics robots and equipment development, and has nearly 200 patents and computer software copyrights, and has become a participant in the formulation of industry standards.

(Source: () iFinD)

Langkun Environment will send 2 yuan date of record every 10 shares in the first half of 2023 as September 25th.

Langkun Environment announced that the company’s half-year equity distribution implementation plan for 2023 is as follows: based on the total share capital of 243,570,700 shares, a cash dividend of RMB 2.00 will be distributed to all shareholders for every 10 shares, with a total cash dividend of RMB 48,714,100, accounting for 50.42% of the net profit attributable to the mother in the same period. No bonus shares will be distributed, and no capital reserve will be converted into share capital.

The distribution of rights and interests in date of record is September 25th, and the ex-dividend date is September 26th.

According to the semi-annual performance report released by Langkun Environment in 2023, the company’s operating income was 792 million yuan, down 14.94% year-on-year; The net profit attributable to shareholders of listed companies was 96.6109 million yuan, a year-on-year decrease of 28.1%; The basic earnings per share was 0.50 yuan, compared with 0.74 yuan in the same period last year.

The main business of Shenzhen Langkun Environment Group Co., Ltd. is organic solid waste (catering waste, kitchen waste, manure, animal solid waste, etc.), harmless treatment and resource utilization of municipal solid waste, and providing related environmental engineering services. The main products or services are organic solid waste treatment services, domestic waste incineration treatment services and environmental engineering services. Through independent research and development and technological innovation, the company has obtained 10 invention patents, 135 utility model patents and 30 software copyrights; The Guangdong Engineering Technology Research Center for Harmless Treatment and Resource Utilization of Organic Wastes built by the company was selected as the first batch of "Guangdong Engineering Technology Research Center" in 2020 recognized by the Guangdong Provincial Department of Science and Technology.

(Source: Straight Flush iFinD)

Today’s international half-year equity distribution in 2023: every 10 shares are sent to 3 yuan for equity registration on September 25th.

Today, the International announced that the company’s equity distribution plan for the first half of 2023 is: based on the company’s existing total share capital, 3 yuan RMB cash (including tax) will be distributed to all shareholders for every 10 shares, with date of record as September 25th, 2023 and ex-dividend date as September 26th, 2023.

Teyi Pharmaceutical Co., Ltd.: The company’s drug nitrendipine tablets passed the consistency evaluation for the first time.

() On the evening of September 19th, it was announced that the company had recently obtained the Notice of Approval for Drug Supplement Application of "Nitrendipine Tablets" approved and issued by National Medical Products Administration. After examination, the above drugs passed the consistency evaluation of generic drug quality and efficacy. The company’s drug nitrendipine tablets were the first to pass the consistency evaluation.

Giant Network sends 1.3 yuan date of record every 10 shares every six months for September 26th.

() It is announced that the company will distribute the equity in the first half of 2023, and distribute the cash dividend to all shareholders for every 10 shares (including tax) in 1.3 yuan and date of record on September 26th.

Teyi Pharmaceutical Co., Ltd.: Nitrendipine Tablets, a drug for treating hypertension, passed the consistency evaluation of generic drugs for the first time.

Teyi Pharmaceutical Co., Ltd. announced that the company recently obtained the Notice of Approval for Drug Supplement Application of "Nitrendipine Tablets" approved and issued by National Medical Products Administration. After examination, the above drugs passed the consistency evaluation of generic drug quality and efficacy. The company’s drug nitrendipine tablets were the first to pass the consistency evaluation.

It is reported that nitrendipine tablets are suitable for the treatment of hypertension. This product is dihydropyridine calcium channel blocker. The product inhibits the transmembrane calcium influx of vascular smooth muscle and myocardium, but its vascular effect is mainly vascular, so its vascular selectivity is strong. The product can dilate systemic blood vessels such as coronary artery and renal arteriole, and has antihypertensive effect.

Yiyi shares: about 140,000 shares were repurchased for the first time.

On September 19, () announced that on September 19, 2023, the company implemented the first share repurchase by centralized bidding through a special account, and repurchased about 140,000 shares of the company, accounting for 0.07% of the company’s current total share capital. The highest transaction price was 15.73 yuan/share, the lowest transaction price was 15.59 yuan/share, and the total transaction amount was about 2.13 million yuan.

If Yuchen bought back 1% of the shares, it cost 23,021,800 yuan.

() Announcement: As of September 15, 2023, the company has repurchased 1.217 million shares by centralized bidding, accounting for 1.00% of the company’s total share capital, with a total turnover of 23.0218 million yuan (excluding transaction costs).

Beijing Lier plans to move its headquarters to Luoyang and sign a cooperation framework agreement with Luoyang government.

() Announced, the company held the 17th meeting of the 5th Board of Directors and 16th meeting of the 5th Board of Supervisors on September 19th, 2023, and reviewed and passed the Proposal on Signing the Cooperation Framework Agreement for Headquarter Relocation to Luoyang with Luoyang Municipal People’s Government and Luoyang Luolong District People’s Government, and the Proposal on Proposed Change of Registered Address, and signed Beijing Lier High Temperature Materials Co., Ltd. with Luoyang Municipal People’s Government and Luoyang Luolong District People’s Government on the same day.

According to the company’s own development status and future strategic planning, in order to obtain more industrial resources, improve the industrial chain layout, optimize the company’s business structure, make full use of policy resources, and promote the company’s steady development, the company plans to move its registered place to Luolong District, Luoyang City, Henan Province. At present, one of the company’s important production bases is located in Luoyang, which has a good industrial base, a perfect industrial base and rich industrial clusters in the fields of high-temperature materials and new energy materials, and has obvious advantages in business environment, industrial chain, talents and policies, which will be conducive to the company’s long-term steady development.

Jinzhi Technology: Winning the bid of 22,996,900 yuan for smart energy-related projects.

() On the evening of September 19th, it was announced that it won the bid for the secondary equipment procurement project of 220kV booster collection station of the first phase of the 2000MW optical storage integration project in Shenneng Shule, with the winning bid amount of 22,996,900 yuan. Shenneng Shule New Energy Development Co., Ltd. is a wholly-owned subsidiary of () Group Co., Ltd..

Jinzhi Technology: Winning the bid of 22,996,900 yuan for smart energy-related projects.

Jinzhi Technology announced on the evening of September 19 that it won the bid for the secondary equipment procurement project of 220kV booster collection station of 500MW project in the first phase of Shenneng Shule 2000MW optical storage integration project, with the winning bid amount of 22,996,900 yuan. Shenneng Shule New Energy Development Co., Ltd. is a wholly-owned subsidiary of Shenzhen Energy Group Co., Ltd.

Beijing Lier: It is planned to move its registered place to Luolong District, Luoyang City, Henan Province.

On the evening of September 19th, Beijing Lier announced that it had signed the Cooperation Framework Agreement for Beijing Lier High Temperature Materials Co., Ltd. to relocate its headquarters to Luoyang with Luoyang Municipal People’s Government and Luoyang Luolong District People’s Government. The company intends to relocate its registered place to Luolong District, Luoyang City, Henan Province. At present, one of the company’s important production bases is located in Luoyang, which has a good industrial base, a perfect industrial base and rich industrial clusters in the fields of high-temperature materials and new energy materials, and has obvious advantages in business environment, industrial chain, talents and policies, which will be conducive to the company’s long-term steady development.

Jinzhi Technology won the bid for 23 million yuan smart energy-related projects of Shenzhen Energy Subsidiary.

Jinzhi Technology announced that recently, the company won the bid for the secondary equipment procurement project of 220kV booster collection station of the 500MW project in the first phase of Shenneng Shule 2000MW optical storage integration project, with the winning bid amount of 22,996,900 yuan. It is reported that the counterparty of this bid-winning project is Shenneng Shule New Energy Development Co., Ltd., a wholly-owned subsidiary of Shenzhen Energy Group Co., Ltd.

Jinzhi Technology won the bid for 23 million yuan smart energy-related projects of Shenzhen Energy Subsidiary.

Jinzhi Technology announced that recently, the company won the bid for the secondary equipment procurement project of 220kV booster collection station of the 500MW project in the first phase of Shenneng Shule 2000MW optical storage integration project, with the winning bid amount of 22,996,900 yuan. It is reported that the counterparty of this bid-winning project is Shenneng Shule New Energy Development Co., Ltd., a wholly-owned subsidiary of Shenzhen Energy Group Co., Ltd.

Giant Network will send 1.3 yuan date of record for every 10 shares in the first half of 2023 as September 26th.

Giant Network announced that the company’s half-year equity distribution implementation plan for 2023 is as follows: based on the total share capital of 1,900,562,000 shares, a cash dividend of 1.30 yuan will be distributed to all shareholders for every 10 shares, and a total cash dividend of 247 million yuan will be distributed, accounting for 37.23% of the net profit attributable to the mother in the same period. No bonus shares will be distributed, and no capital reserve will be converted into share capital.

The distribution of rights and interests in date of record is September 26th, and the ex-dividend date is September 27th.

According to the semi-annual performance report released by Giant Network in 2023, the company’s operating income was 1.443 billion yuan, a year-on-year increase of 35.68%; The net profit attributable to shareholders of listed companies was 664 million yuan, a year-on-year increase of 32.95%; The basic earnings per share was 0.36 yuan, compared with 0.27 yuan in the same period last year.

The main business of Giant Network Group Co., Ltd. is the research and development and operation of Internet games. At present, the company’s two main product lines are "Journey" series and "Ball-Ball Battle". After more than ten years of accumulation, "Journey" IP has a huge user base, which once set a historical record of 2.1 million players being online at the same time. "Ball Fight" is a leisure and competitive mobile game independently developed and operated by the company. It has created a new category of mobile e-sports, and the cumulative equipment installation has exceeded 600 million units.

(Source: Straight Flush iFinD)

Yiming Medicine: At present, the company’s operation is normal, and there are no matters that should be approved but not approved.

() Announcing the change, the company’s current operating conditions are normal, and the internal and external operating environment has not changed significantly; After verification, the company, the controlling shareholder and the actual controller do not have any major matters that should be disclosed but not disclosed about the company, or major matters in the planning stage.

Huatian Hotel intends to be entrusted to manage 80% equity of Sunshine Wine Tube.

Huatian Hotel announced that in order to solve the problem of horizontal competition between the controlling shareholder Hunan Tourism Group and the company, it is proposed that the company be entrusted to manage the 80% equity of Hunan Sunshine Hotel Management Co., Ltd., a subsidiary of Hunan Tourism Group. The custody period shall be from the effective date of the equity custody agreement to December 31, 2026.

The subsidiary of New Beiyang Holdings won the bid for the procurement project of upgraded self-service teller machines of China Construction Bank.

New Beiyang announced that Rongxin Technology, a holding subsidiary of the company, recently received the Notice of Winning Bid issued by CITIC International Bidding Co., Ltd., and confirmed Rongxin Technology as the winning bidder of the "China Construction Bank Co., Ltd. Upgrade ATM Procurement Project". Rongxin Technology will handle the contract signing and other related matters with China Construction Bank Co., Ltd. as soon as possible, and the specific implementation content of the project will be subject to the formal contract.

Yubang New Materials: The online winning rate of "Yubang Convertible Bonds" is 0.000905603%.

() It was announced that the original shareholders of the company gave priority to placing 4,116,252 Yubang convertible bonds, namely 411,625,200.00 yuan, accounting for 82.33% of the total convertible bonds issued this time.

A total of 883,740 convertible bonds were finally issued online to public investors, namely 88,374,000.00 yuan, accounting for 17.67% of the total issuance, and the online winning rate was 0.0009705603%.

According to the online subscription information provided by Shenzhen Stock Exchange, the number of valid online subscriptions issued to public investors is 91,054,615,200, with a total number of 9,105,461,520, and the starting and ending numbers are 000000000001-009105461520.

Hanyu Pharmaceutical signed a $30 million GLP-1 polypeptide bulk drug sales contract.

() Announcement: Recently, the company and its wholly-owned subsidiary Hanyu Pharmaceutical (Wuhan) Co., Ltd. ("Hanyu Wuhan") signed a major daily operation contract with overseas customers. According to the contract, the customer is expected to purchase GLP-1 polypeptide APIs with a total amount of USD 30 million (about RMB 219 million (including tax)) from the company and Hanyu Wuhan, accounting for 31.11% of the total audited revenue in 2022 and 244.23% of the audited API business in 2022.

Huang Guorong, a shareholder of Tailong Co., Ltd., has reduced his shareholding by 1.04%.

() Announcement. Recently, the company received the Letter of Information on changes in equity issued by Huang Guorong, a shareholder holding more than 5% of the shares. During the period from May 11th to September 15th, 2023, shareholder Huang Guorong reduced his holding of 2,275,200 shares of the company through bidding and block trading, accounting for 1.04% of the total shares of the company, reaching 1% of the total share capital of the company.

Su Fang and Huang Guorong, shareholders of Tailong, reduced their holdings by 3.14%.

Tailong Co., Ltd. announced that the company recently received the Notice Letter on the Expiration of the Reduction Plan issued by shareholders Su Fang and Huang Guorong. As of September 16, 2023, Su Fang and Huang Guorong’s reduction plans have expired, reducing their shares by 1.81% and 1.33% respectively.

Shanghai Jianyuan Equity Investment Fund, the major shareholder of Huada Jiutian, reduced its shareholding by 1.32%.

() Announcement: Shanghai Jianyuan Equity Investment Fund Management Partnership (Limited Partnership)-Shanghai Jianyuan Equity Investment Fund Partnership (Limited Partnership), which holds more than 5% of the company’s shares, reduced its shareholding by 7,187,300 shares from August 14, 2023 to September 8, 2023, with a change ratio of equity of 1.32%.

A large proportion of Dahongli’s 67.5133 million restricted shares will be listed and circulated on September 21st.

() Announcement: The number of shares issued before the company’s initial public offering is 67,513,300 shares, accounting for 70.56% of the company’s total share capital; The listing date is Thursday, September 21st, 2023.

Hailian Jinhui: It is planned to buy back shares of RMB 300 million to RMB 600 million.

() On the evening of September 19th, it was announced that the company planned to buy back the shares for 300-600 million yuan for the subsequent implementation of the employee stock ownership plan or equity incentive plan. The repurchase price shall not exceed 9 yuan/share.

Hailian Jinhui plans to spend 300 million yuan to 600 million yuan to repurchase shares, and the repurchase price does not exceed 9 yuan/share.

Hailian Jinhui announced that the company intends to use its own funds to buy back some RMB ordinary shares (A shares) issued by the company in a centralized bidding transaction for the subsequent implementation of the employee stock ownership plan or equity incentive plan. The total amount of funds to be used for repurchase is not less than 300 million yuan (inclusive) and not more than 600 million yuan (inclusive), and the repurchase price is not more than 9 yuan/share. According to the total amount of funds to be used for repurchase and the upper limit of repurchase price, it is estimated that the number of shares to be repurchased is about 66,666,666, accounting for 5.68% of the company’s total share capital.

China Tianying: Signed a cooperation agreement with Youyu County Government on the 100MWh gravity energy storage project.

() On the evening of September 19th, it was announced that Jiangsu Nengying, a wholly-owned subsidiary of the company, recently signed the Cooperation Agreement of China Tianying 100MWh Gravity Energy Storage Project with the People’s Government of Youyu County, Shuozhou City, Shanxi Province. The construction content includes energy storage system, power generation system, transmission system, control system, booster station, gravity block and other public and auxiliary supporting systems.

Hailian Jinhui terminates the issue of A shares to specific targets in 2022.

Hailian Jinhui announced that in view of the changes in the current capital market environment, the company comprehensively considered the actual situation, development planning and many other factors, and after full communication and careful analysis with relevant parties, the company decided to terminate the issue of A shares to specific targets in 2022.

Haige Communication’s subsidiary selected about 2.015 billion yuan for China Mobile’s procurement project.

() Announced. Previously, Haige Yichuang, a wholly-owned subsidiary of the company, was one of the successful candidates in 15 regions, namely, Guangdong, Henan, Hunan, Guizhou, Shandong, Shaanxi, Guangxi, Fujian, Liaoning, Hubei, Beijing, Heilongjiang, Hebei, Shanghai and Inner Mongolia. On August 11th, 2023, China Mobile Purchasing & Bidding Network released the announcement of the successful candidates in Sichuan for the "China Mobile Communications Group’s network comprehensive maintenance service procurement project from 2023 to 2026". Haige Yichuang is one of the successful candidates, and it is estimated that the contract amount won in the whole service cycle will be 125 million yuan. Recently, Haige Yichuang officially received the Notice of Winning the Bid issued by the bidding agency entrusted by China Mobile Group, with a total winning amount of about 2.015 billion yuan.

The signing and performance of the above-mentioned contract for the selected project is expected to play a positive role in promoting the position of the company and Haige Yichuang in the communication service industry and the performance growth from 2023 to 2026.

(): The subsidiary plans to invest 361 million yuan to build the high-grade CNC machine tool industrial park (Phase I) project of Baoji Machine Tool Group.

Qinchuan Machine Tool announced that Baoji Machine Tool Group Co., Ltd., a holding subsidiary, plans to invest in the construction of "Baoji Machine Tool Group High-end CNC Machine Tool Industrial Park (Phase I)" in Gaoxin 17th Road, Baoji High-tech Development Zone, with a total investment of 361 million yuan and a construction period of 2 years.

SF Holdings: In August, the revenue of express logistics business increased by 2.41% year on year.

() It was announced on the evening of September 19th that the revenue of express logistics business in August was 15.054 billion yuan, up by 2.41% year-on-year; Revenue from supply chain and international business was 5.218 billion yuan, down 27.41% year-on-year. The year-on-year decline in supply chain and international business income was mainly affected by the year-on-year decline in international air and sea freight prices, but the income rebounded from July.

Tianli Lithium can receive the supervision letter from Shenzhen Stock Exchange.

() Announcement: On September 19, 2023, the company received the Supervision Letter on Xinxiang Tianli Lithium Energy Co., Ltd. issued by the Growth Enterprise Market Company Management Department of Shenzhen Stock Exchange. The supervision letter pointed out that:

On August 31, 2023, the Special Report on the Deposit and Use of the Company’s Raised Funds in the Half Year of 2023 disclosed by the company showed that the company made a mistake in using the payment account due to operational errors, and used the raised funds to pay the accumulated amount of 6,002,000 yuan for non-raised investment projects. After self-examination, it was found that it had been replaced with its own funds. The above behavior violates Article 1.4 of the Listing Rules of Growth Enterprise Market (revised in 2023) and Article 6.3.1 of the Guidelines for Self-regulation of Listed Companies No.2-Standardized Operation of Listed Companies on Growth Enterprise Market.

China Tanya Subsidiary signed a cooperation agreement with Youyu County People’s Government on the 100MWh gravity energy storage project.

China Tianying announced that in order to implement the national double-carbon goal, give full play to the advantages of both partners and promote the full development and utilization of Youyu new energy resources, Jiangsu Nengying New Energy Technology Development Co., Ltd., a wholly-owned subsidiary of the company, recently signed the Cooperation Agreement of China Tianying 100MWh Gravity Energy Storage Project with the people’s government of Youyu County, Shuozhou City, Shanxi Province for the purpose of common development and win-win cooperation.

Youyu County is located in the northwest of Shanxi Province, where scenery and electricity have unique resource advantages, and the green energy industry has a strong development momentum. The 100MWh gravity energy storage project invested and constructed by the company in Youyu County will give full play to the resource advantages of both parties and form the integration and complementarity of advantages, which will not only promote the full development and utilization of Youyu’s new energy resources and help Youyu’s green, low-carbon and high-quality development, but also help the company to systematically build the development ecology of new energy industry and continuously expand the application scenarios and potential markets of gravity energy storage technology. The landing of the project is in line with the development direction of the company’s "environmental protection+new energy" dual-engine drive strategy, and will also have a positive impact on the company’s new energy business development and business performance improvement in the future.

Accurate information plans to pay 1.34 yuan for 10 shares, which will be ex-dividend on September 28.

() Announcement, the company plans to distribute the rights and interests in the first half of 2023: 1.34 yuan (including tax) for every 10 shares of all shareholders; Ex-dividend date: September 28, 2023.

Guotong intends to transfer 79% equity of Sinoma Jiulong River and 99% equity of Tianhe Shanshan.

() Announce, in order to integrate the company’s high-quality resources, optimize the allocation of resources, play a synergistic effect, improve the company’s strategic layout, and further enhance the company’s sustainable profitability. The company intends to transfer 79% equity of Fujian Sinoma Jiulong River Investment Co., Ltd. and 99% equity of Xinjiang Tianhe Shanshan Construction Engineering Co., Ltd. through the listing of Beijing Property Rights Exchange.

As of June 30, 2023 (unaudited), Sinoma Jiulong River had total assets of 890,183,400 yuan, total liabilities of 697,438,800 yuan and owner’s equity of 192,744,600 yuan; From January to June, 2023, it realized an operating income of 31,849,100 yuan, an operating profit of-6,593,700 yuan, a total profit of-6,571,600 yuan and a net profit of-6,571,600 yuan.

As of June 30, 2023 (unaudited), Tianhe Shanshan had total assets of 600,729,600 yuan, total liabilities of 511,868,100 yuan and owner’s equity of 88,861,500 yuan; From January to June, 2023, 0 yuan achieved operating income, with operating profit of-8,490,900 yuan, total profit of-8,490,900 yuan and net profit of-8,490,900 yuan.

Qinchuan Machine Tool: The holding subsidiary plans to invest in the high-grade CNC machine tool industrial park (Phase I) project of Baoji Machine Tool Group.

Qinchuan Machine Tool announced on the evening of September 19th that the holding subsidiary of the company plans to invest in the construction of "Baoji Machine Tool Group High-end CNC Machine Tool Industrial Park (Phase I) Project", with a total investment of 361 million yuan.

Haida Group: Terminate the company’s issue of A shares to specific targets in 2022 and withdraw the application documents.

() It was announced on the evening of September 19th that, based on the progress of the company’s issuance of shares to specific targets, and considering the capital market environment and the overall development plan of the company, after full communication and careful analysis with relevant parties, the company decided to terminate the issue of A shares to specific targets in 2022 and withdraw the application documents.

Kabeiyi granted 1,098,000 shares of Class II restricted stock at a grant price of 43.24 yuan/share.

() Announcement: The company held the 14th meeting of the third board of directors on September 19, 2023, deliberated and passed the Proposal on Granting Restricted Shares to Incentive Objects, and decided to grant 129 incentive objects 1,098,000 Class II restricted shares at the grant price of 43.24 yuan/share on September 19, 2023.

Song Cheng Performing Arts granted 11.213 million restricted shares at a grant price of 6.36 yuan/share.

() Announcement, the conditions for the first grant of restricted shares stipulated in the company’s restricted stock incentive plan in 2023 have been achieved, and the company reviewed and approved the Proposal on the First Grant of Restricted Shares to Incentive Objects, and determined that the first grant date of restricted shares was September 19, 2023, and 5,400,000 first-class restricted shares and 5,813,000 second-class restricted shares were granted to incentive objects; The first grant price is 6.36 yuan/share.

Ruo Yuchen: Accumulated repurchase of about 1.22 million shares.

On September 19th, Ruo Yuchen announced that as of September 15th, 2023, the company had bought back about 1.22 million shares of the company by centralized bidding through the special securities account, accounting for 1% of the company’s total share capital. The highest transaction price was 20.89 yuan/share, the lowest transaction price was 133.44 yuan/share, and the total transaction amount was about 23.02 million yuan.

Hanyu Pharmaceutical signed a GLP-1 polypeptide API sales contract with a cumulative amount of 30 million US dollars.

Hanyu Pharmaceutical announced that recently, the company and its wholly-owned subsidiary Hanyu Wuhan signed a major daily operation contract with overseas customers. According to the contract, the customer expects to purchase GLP-1 polypeptide raw materials with a total amount of USD 30 million (about RMB 219 million (including tax)) from the company and Hanyu Wuhan. The accumulated amount of this contract accounts for 31.11% of the total audited revenue in 2022 and 244.23% of the audited API business in 2022.

Jiayun Technology appoints Yang Jiade as General Manager.

() Announcement, the board of directors of the company decided to hire Yang Jiade as the general manager and Tony Cheung as the deputy general manager of the company. After the change, Yang Jiade will no longer serve as the deputy general manager of the company. The term of office of the above-mentioned personnel shall be from the date of deliberation and approval at the 24th meeting of the fifth board of directors to the date of expiration of the term of office of the fifth board of directors.

Hailian Jinhui plans to spend 300 million to 600 million yuan to buy back shares.

Hailian Jinhui announced that the company intends to use its own funds to buy back some RMB common shares (A shares) issued by the company in a centralized bidding transaction for the subsequent implementation of the employee stock ownership plan or equity incentive plan. The total amount of funds to be used for repurchase this time is not less than 300 million yuan, not more than 600 million yuan, and the repurchase price is not more than 9.00 yuan/share.

Mingke Jingji: The company’s current operating conditions and internal and external operating environment have not changed significantly.

() On the evening of September 19th, the announcement of abnormal fluctuation of stock trading was released. Recently, AITO, a downstream customer of the company (), went public and started delivery, which caused widespread concern in the market. The company’s current operating conditions and internal and external operating environment have not changed significantly. Here, the company reminds investors to pay attention to investment risks and invest rationally.

Guangzheng Ophthalmology granted 8,544,900 restricted shares at a grant price of 3.3 yuan/share.

() Announcement, regarding the first grant of restricted shares to the incentive objects of the restricted stock incentive plan in 2023, the board of directors of the company agreed to set the first grant date as September 19th, 2023, and grant 8,544,900 restricted shares to 286 incentive objects meeting the grant conditions at the grant price of 3.3 yuan/share.

* 59,258,200 shares of Xinwang Capital, the concerted action of ST Changfang controlling shareholder, were frozen by the judiciary.

() Announcement: Nanchang Xinwang Capital Enterprise (Limited Partnership) ("Xinwang Capital"), the concerted action of Nanchang Xiangping Technology Group Co., Ltd. ("Xiangping Technology"), the controlling shareholder of the company, held 59,258,200 shares (accounting for 7.5% of the company’s total share capital) and was frozen by the judiciary.

It is reported that the reasons for the judicial freezing of Xinwang Capital’s shares are not clear, and shareholders are actively understanding the reasons for the judicial freezing of shares and striving for an early and proper solution.

Zhou Dasheng’s half-year equity distribution in 2023: every 10 shares will be distributed to 3 yuan for equity registration on September 25th.

() Announced that the company’s equity distribution plan for the first half of 2023 is as follows: based on the existing total share capital of the company excluding the repurchased shares, 3 yuan RMB cash (including tax) will be distributed to all shareholders for every 10 shares, with date of record as September 25th, 2023 and ex-dividend date as September 26th, 2023.

Xiangtai Science, a subsidiary of Fuxiang Pharmaceutical, passed GMP compliance inspection.

() Announcement: Jiangxi Xiangtai Life Science Co., Ltd. (referred to as "Xiangtai Science"), a wholly-owned subsidiary of the company, recently received the Notice of GMP Compliance Inspection Results of Jiangxi Drug Administration issued by Jiangxi Drug Administration.

Yutong Technology plans to pay 3.27 yuan for every 10 shares in half a year, and ex-dividend on September 26th.

() Announcement: In the first half of 2023, the company plans to distribute cash of RMB 3.27 yuan (including tax) to all shareholders for every 10 shares, and will not send bonus shares or convert reserve funds into share capital.

This date of record is September 25th, 2023, and the ex-dividend date is September 26th, 2023.

Shuanghuan Technology plans to sign a cooperation intention agreement with Guodian Investment Jingchu Energy Co., Ltd.

() Announcement, the company intends to sign the Cooperation Intention Agreement with Guodian Investment Jingchu Energy Co., Ltd., and the company intends to cooperate with Guodian Investment Jingchu Energy Co., Ltd. to build a 300MW compressed air energy storage power station project in Yingcheng through various means such as renting and transferring salt cave resources.

If the cooperative project is finally implemented, the company will participate in the mode of renting or transferring salt caves, which may bring some benefits to the company. At that time, both parties still need to sign a formal cooperation agreement before determining the impact on the company.

Huafu Fashion intends to terminate the implementation of the 2021 stock option incentive plan.

() Announcement was issued. Since the first extraordinary general meeting of shareholders in 2021 reviewed and approved the 2021 stock option incentive plan, the company has actively promoted relevant implementation work. In view of the changes in the internal and external market environment, the exercise conditions of the equity incentive plan are no longer available, and this equity incentive plan cannot be continued.

In order to fully protect the interests of the incentive targets, the company and all shareholders, combined with the company’s future development plan, the company intends to terminate the implementation of the 2021 stock option incentive plan ahead of schedule and cancel 50 million stock options to be granted but not exercised. At the same time, the supporting "2021 Stock Option Incentive Plan (Draft)" and its abstract and other related documents shall be terminated. According to the Measures for the Administration of Equity Incentives of Listed Companies and other relevant regulations, the board of directors of the company will handle the cancellation procedures of relevant stock options after the shareholders’ meeting deliberates and approves the termination of the implementation of this incentive plan.

Shanghai Hanxun made provision for asset impairment of 10,228,200 yuan.

() Announcement: The company made provision for impairment from April 1, 2023 to August 31, 2023, totaling RMB 10,228,200.

The controlling shareholder of Yuanxing Energy released about 258 million shares from pledge.

() Announcement. Recently, the company inquired through the system of China Securities Depository and Clearing Co., Ltd., and learned that some shares of the company held by Inner Mongolia Boyuan Holding Group Co., Ltd., the controlling shareholder of the company, were pledged, and this time about 258 million shares were pledged, accounting for 7.12% of the company’s total share capital.

Power Transmission sends 4.5 yuan date of record every 10 shares every six months for September 26th.

() It is announced that the company will distribute the equity in the first half of 2023, and distribute cash 4.5 yuan (including tax) to all shareholders for every 10 shares, with date of record as September 26th, 2023.

Oriental Fortune: Signing the Maximum Guarantee Contract

() On the evening of September 19th, it was announced that Tiantian Fund, a wholly-owned subsidiary of the company, continued to cooperate with Shanghai Branch of China Everbright Bank due to the needs of business development, and the term of the cooperation agreement was one year. The company provides the guarantee of the highest joint liability for Tiantian Fund, so as to guarantee Tiantian Fund to pay off all its debts under the relevant cooperation agreement in full, and the maximum balance of the guaranteed principal creditor’s rights totals 1,000,000,000 yuan. The period of undertaking the guarantee responsibility is three years from the expiration of the debt performance period of Tiantian Fund as stipulated in the specific credit business contract or agreement. The maximum guarantee contract related to the above guarantee has been signed.

The total balance of some bank accounts of Tianji Technology was 262 million yuan, which was frozen.

() Announcement: At 16:00 p.m. on September 15th, 2023, the company learned that some bank accounts of the company were frozen, with a total balance of 262 million yuan. At present, the company has not been able to determine the specific reasons for the freezing of accounts, and information will be disclosed in time according to the development of the matter.

The frozen bank account is a general deposit account, and it will not affect the company’s capital turnover and normal business activities so far, which is within the controllable scope. The management of the company will actively communicate with relevant parties and strive to lift the frozen bank account funds as soon as possible.

Jinlun Holdings, the major shareholder of the property Jinlun, reduced its holdings by 1,139,300 shares.

() Announcement, the company received the Letter of Notice on the Expiration of the Reduction Plan issued by Nantong Jinlun Holdings Co., Ltd. (hereinafter referred to as "Jinlun Holdings"), which holds more than 5% of the shares, and learned that Jinlun Holdings has completed the implementation of this reduction plan. Jinlun Holdings reduced its holdings by 1,139,300 shares, with a reduction ratio of 0.55%.

Shentong Express’s express service business revenue in August was 3.188 billion yuan, up 7.63% year-on-year.

() Announcement: In August 2023, the company’s express delivery service revenue was 3.188 billion yuan, a year-on-year increase of 7.63%; The business volume was 1.521 billion votes, a year-on-year increase of 24.04%; The single ticket revenue of express delivery service was 2.10 yuan, down 13.22% year-on-year.

Zhu Shanzhong, the shareholder of Property Jinlun, and his concerted actions have reduced their holdings by 1.83% of the company’s shares.

The product Golden Wheel issued an announcement. The company received the Notice Letter on the Expiration of the Reduction Plan issued by the shareholder Zhu Shanzhong and his concerted actions Zhu Shanbing and Hong Liang, and learned that Zhu Shanzhong and his concerted actions Zhu Shanbing and Hong Liang had completed the implementation of this reduction plan. The above shareholders reduced their holdings of 3,793,300 shares of the company, with a total reduction ratio of 1.83%.

Accurate information will be distributed at 1.34 yuan for every 10 shares in the first half of 2023, and date of record will be September 27th.

The accurate information release announcement, the company’s half-year equity distribution implementation plan in 2023 is as follows: based on the total share capital of 737,265,300 shares, a cash dividend of RMB 1.34 will be distributed to all shareholders for every 10 shares, and a total cash dividend of RMB 98,793,500 will be distributed, accounting for 204.7% of the net profit attributable to the mother in the same period. No bonus shares will be distributed, and no capital reserve will be converted into share capital.

The distribution of rights and interests in date of record is September 27th, and the ex-dividend date is September 28th.