28 yuan of millet, still did not get rid of the troubles of 8 yuan.

Text | Slightly refer to Yang Zhichao

Edit | Harano

In 2019 and 2022, Xiaomi’s share price fell below 9 yuan.

There are too many reasons, mainly focusing on the lack of brand power and low R&D investment. This makes most of Xiaomi’s products lack brand premium and the final profit rate is low.

At present, 8 yuan Xiaomi has become a distant past tense. With the release of Xiaomi SU7, Xiaomi’s brand has experienced a historical qualitative change in less than a year, and its cars have become synonymous with face and trend. Even 800,000 cars can be ordered for 3,000 units in 10 minutes. The sales of high-end mobile phones and household appliances have also increased with the improvement of Xiaomi.

A rising tide lifts all boats, and Xiaomi’s share price has exceeded 28 yuan. However, in the third quarter financial report just released by 28 Xiaomi, you can still see some troubles that Xiaomi encountered when he spent 8 yuan.

01 28 pieces of millet is still not easy.

Two weeks ago, Qualcomm released its financial report for the fourth fiscal quarter, that is, the financial report for the third natural quarter.

The financial report shows that Qualcomm’s net profit increased by more than 40% year-on-year. Specific to the third quarter, Qualcomm’s net profit reached 2.92 billion US dollars, about 20 billion RMB, up 96% year-on-year. China customers alone contributed 46% of Qualcomm’s revenue.

But Qualcomm’s bonus, in turn, is the pressure of customers in China.

In the third quarter, Xiaomi’s global smartphone shipments reached 43.1 million units, a year-on-year increase of 3.1%. In addition to the sales growth, the average selling price of Xiaomi mobile phone also increased by 10.6%, reaching 1102 yuan. In the end, the revenue increased by 13.9% year-on-year to reach 47.5 billion yuan.

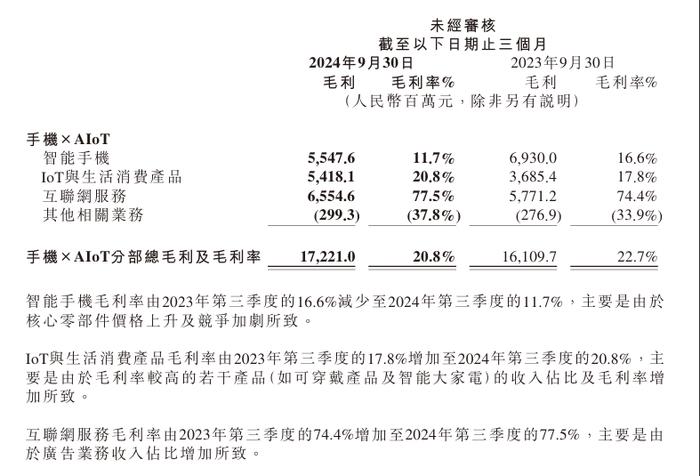

However, the gross profit from mobile phones has decreased. In the third quarter, the gross profit of Xiaomi smartphones dropped from 6.93 billion yuan to 5.547 billion yuan. Gross profit margin decreased by nearly 5 percentage points year-on-year to 11.7%. With revenue accounting for 45.3%, Xiaomi’s smartphone gross profit has been surpassed by Internet services, only about 130 million yuan more than AIoT business.

The reason for the decline in gross profit margin of mobile phone business has been warned in advance by Lei Jun.. On November 18th, Lu Weibing explained it again at the performance meeting: the price increase of raw materials (Lu Weibing directly means memory) just happened to catch up with the release cycle of low-margin products.

The price increase of raw materials has been going on for several months. As early as May this year, Li Nan, a former Meizu executive, said in Weibo that domestic mobile phone brands were overwhelmed by Qualcomm’s "robbery" price of 140-160 dollars. Last month, Guo Ming said on social media that the unit price of Snapdragon 8 Extreme Edition processor increased by about 15% to $180 compared with Snapdragon 8 Gen3. In addition to the price increase in Qualcomm, the prices of memory and screen are also rising at a double-digit rate.

It can also be seen from this that even with the brand qualitative change brought by Xiaomi SU7, the business of selling mobile phones is still very bitter: it has finally ushered in the recovery of global mobile phone consumption, but chip manufacturers still have bargaining power, and they can easily eat the increase in profits.

Of course, for Xiaomi, Internet service revenue is actually an extension of mobile phone business and should be considered together. In the third quarter, Xiaomi’s Internet revenue reached 8.5 billion yuan, and the gross profit margin reached 77.5% due to the growth of shipments. Although the revenue was only 8.5 billion yuan, it was the highest gross profit business of Xiaomi in the third quarter, reaching 6.554 billion yuan.

The "good days" of Xiaomi’s mobile phone may still be behind: Xiaomi 15′ s sales exceeded one million in just nine days, and it won the first place in the weekly sales of high-end mobile phones. It is basically certain that it is a phenomenal explosion, and the profit it brings will be reflected in the fourth quarter financial report.

At the performance meeting, Lu Weibing also mentioned that the price of raw materials will fall in the fourth quarter: the supply chain began to rise in the first two quarters, and it has risen to its peak in the third quarter, and there will be some decline in the fourth quarter.

Generally speaking, for the evaluation of Xiaomi’s financial report, especially the mobile phone business, we can apply Wang Xing’s famous saying: this is the best quarterly report in Xiaomi’s history, but it is also the worst quarterly report in the next few quarters.

02 Xiaomi SU7 accidentally hit Dong Mingzhu?

Only in the third quarter, AIoT is the business most affected by the brand upgrade brought by Xiaomi SU7.

Not long ago, Lei Jun and Dong Mingzhu launched a battle from a distance: In June this year, Dong Mingzhu called the roll at the shareholders’ meeting: "Xiaomi said that he won the first place, relying on other manufacturers to make products. What is your technology? Who is the first, consumers have a steelyard. " Lei Jun and Lu Weibing responded in July and November respectively, saying that Xiaomi was the first, and Sister Dong’s criticism was not true.

Regardless of whether Xiaomi has expressed that he is the first, this mutual shouting reflects at least one thing: Xiaomi has increasingly worried traditional home appliance brands.

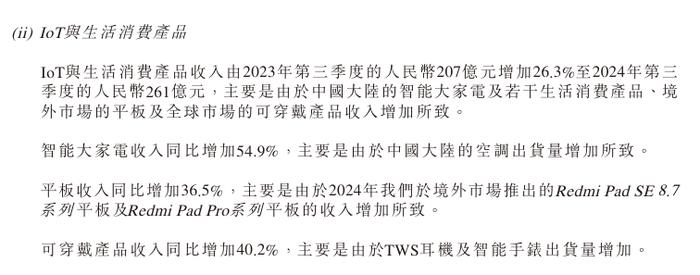

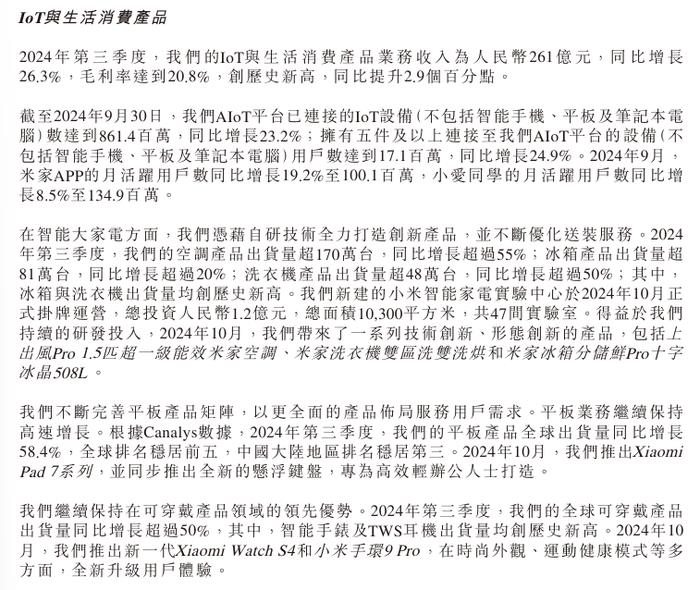

In the third quarter, Xiaomi’s business income from AIoT and consumer products (hereinafter referred to as AIoT) reached 26.1 billion yuan, up 26.3% year-on-year, and the growth rate was about twice that of mobile phones.

In terms of products, air-conditioning shipments exceeded 1.7 million units, up more than 55% year-on-year. According to third-party data, Xiaomi is already the third air-conditioning brand in China. Although it is twice as big as Gree, it is growing rapidly. No wonder Dong Mingzhu fired at Xiaomi. In addition, the shipment of washing machines exceeded 480,000 units, a year-on-year increase of more than 50%, and the shipment of refrigerators exceeded 810,000 units, a year-on-year increase of more than 20%. Both hit record highs. In the end, the revenue of Xiaomi’s household appliances increased by 54.9% year-on-year.

Another growth of AIoT comes from wearable devices. In the third quarter, Xiaomi’s global wearable product shipments increased by more than 50% year-on-year, and its revenue increased by 40.2% year-on-year. Xiaomi’s headphones, watches and bracelets are more and more popular with consumers, driven by the brand power of Xiaomi SU7.

The growth of these two businesses directly increased the gross profit margin of AIoT business.

In the third quarter, the gross profit margin of AIoT business reached an astonishing 20.8%, a record high-this is more profitable than selling cars and mobile phones. In the financial report, Xiaomi attributed the increase in gross profit margin of AIoT to the increase in income of products such as wearable devices and household appliances.

In fact, the high gross profit of wearable devices is not a secret. As early as the release of Apple Watch, a third-party report showed that the gross profit margin of Apple Watch was as high as 60%, which was more profitable than iPhone. On the household appliances side, the gross profit margins of Midea, Haier and Hisense, the three giants of traditional air conditioners, are all above 25%, which is higher than the average level of the mobile phone and automobile industries.

In the financial report, Xiaomi also disclosed a data similar to Taobao 88VIP: the number of users with five or more AIoT devices reached 17.1 million, a year-on-year increase of 24.9%. These users, like loyal buyers of e-commerce, can provide the highest customer unit price and the highest repurchase rate.

This is another brand driving force of Xiaomi outside the car: the reliable brand image with high and low limits has cultivated more and more die-hard fans. Xiaomi is not necessarily the optimal solution for them, but it is the choice with the highest lower limit. A strong sense of trust has made Xiaomi’s brand image more like Muji and become a "department store brand" with high and low limits.

Judging from the third quarter financial report, the growth potential of AIoT may be even greater than that of mobile phones. After all, a person can usually only buy 1-2 mobile phones, but AIoT business includes all kinds of wearable devices, home appliances, and even gel pens, patch panels, pillows, towels and other daily necessities.

If the "88VIP" with more than five pieces of AIoT equipment is further expanded, the imagination of Xiaomi brand will be difficult to describe.

03 Best Xiaomi SU7, Difficult Automobile Industry

Three months later, Xiaomi’s bicycle earning ability has been able to wrestle with Tesla.

In the third quarter, Xiaomi’s innovative business income such as smart electric vehicles was 9.7 billion yuan, and the adjusted net loss was 1.5 billion yuan, with a loss rate of about 15.46%. In contrast, Weilai, with higher sales volume, lost about 37% in the first half of the year.

This is only data that has been delivered for less than a year.

Xiaomi’s unexpected low loss stems from its ultra-high gross profit margin. In the third quarter, the gross profit margin of Xiaomi SU7 increased by two percentage points from the previous quarter, reaching 17.1%. This figure is exactly the same as Tesla’s gross profit margin of auto business in the third quarter.

At present, the highest gross profit margin of the new forces is ideal: more than 20%. But look carefully, Xiaomi’s number is even scarier than ideal.

In the third quarter, the delivery volume of Xiaomi was only 39,790 units, which was less than the ideal one-month sales. The gross profit margin is directly affected by sales volume. In the words of Lu Weibing at the performance meeting, "Xiaomi Automobile is still in its early stage and its scale is not large enough. Self-built factories, self-developed core technologies, heavy investment in the early stage, and cost sharing, so there was a loss in the early stage. "

It is not difficult to imagine that if Xiaomi’s production capacity continues to climb and the scale effect is further displayed, it is likely to become the new energy vehicle enterprise with the highest gross profit margin, even higher than Tesla, BYD and Ideal in the past.

Even if the gross profit margin of Xiaomi Auto remains unchanged, even if all sales are calculated according to the starting price of Xiaomi SU7, Xiaomi will hopefully break even as long as it sells about 40,000 more cars every quarter, reaching a monthly sales volume of about 26,000-this is already the most pessimistic expectation, and the monthly sales volume of Xiaomi Auto has exceeded 20,000 in October.

If there are no accidents, Xiaomi Automobile will undoubtedly become the fastest profitable new car-making force, far faster than all new energy car companies including Ideal and Tesla.

For Xiaomi Auto, which has handed over a nearly perfect report card, the biggest risk may come from the industry: the new energy track itself is becoming more and more cruel, and even the most powerful ideal among the new forces is facing the double pressure of sales and profits-the failure of a MEGA almost made the ideal fall from heaven to hell. For car companies, every car is a big test that cannot be lost.

At present, Xiaomi has won in almost all battlefields, but if it wants to keep winning in these tracks where it is located, it still can’t relax for a moment.